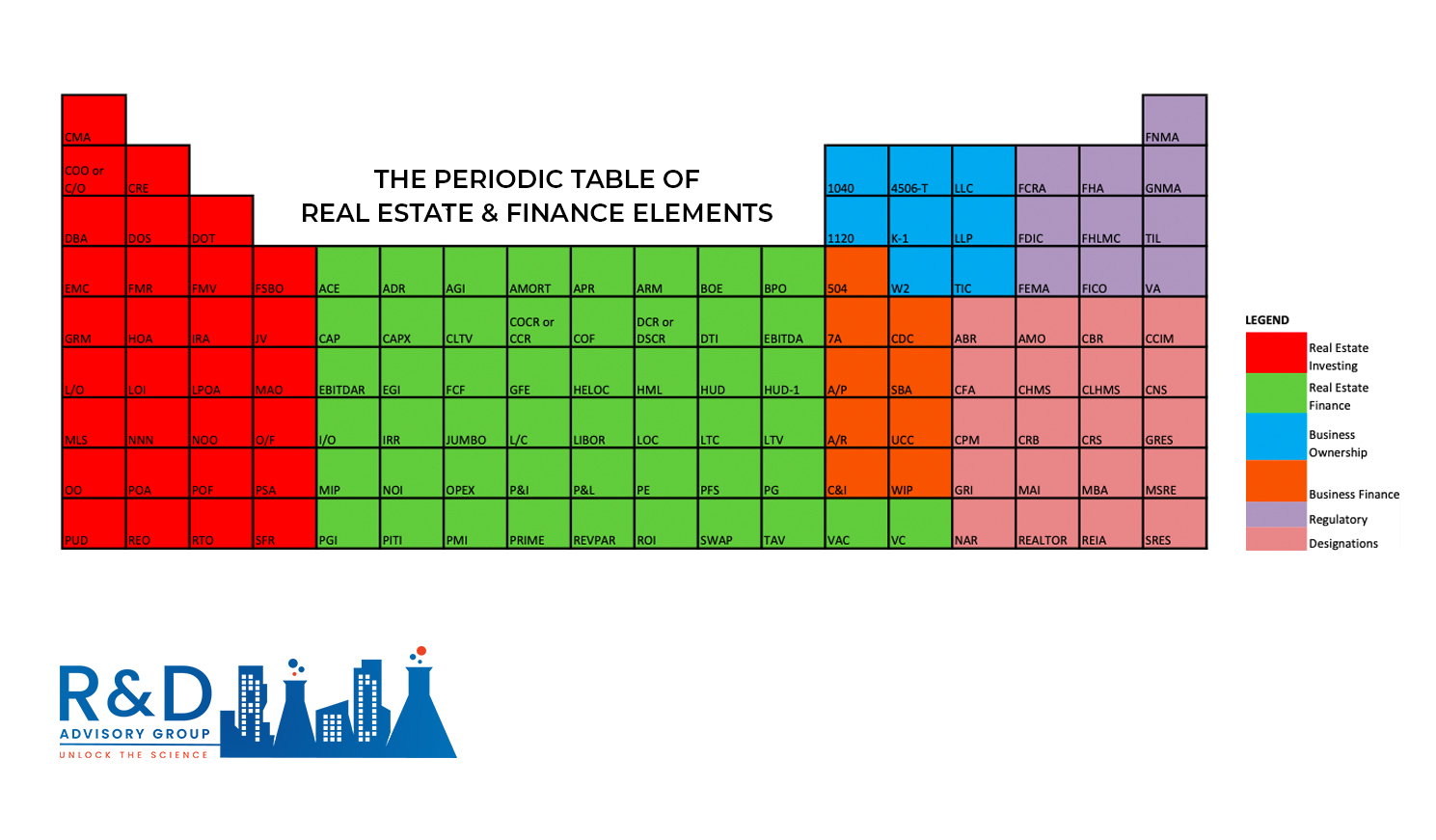

Glossary

There is an extensive vocabulary used by the capital market andreal estate industries, many of which are abbreviated in day-to-day discussions, on contracts and agreements, and by agents and lenders. This directory of terms was designed to ensure that every stakeholder in the conversation, regardless of their industry knowledge, is well versed and up to speed.

Real Estate Investing

- CMA – An examination of the prices at which similar properties in the same area recently sold.

- COO or C of O – Certificate of

Occupancy

A document issued by a local government agency or building department certifying a building's compliance with applicable building codes and other laws, and indicating it to be in a condition suitable for occupancy.

- CRE – Commercial Real Estate

Any non-residential property used for commercial profit-making purposes.

- DBA – Doing Business As

A company is said to be "doing business as" when the name under which they operate their business differs from its legal, registered name.

- DOS – Due On Sale Clause

A clause in a loan or promissory note that stipulates that the full balance of the loan may be called due (repaid in full) upon sale, or upon transfer of ownership of the property used to secure the note. The lender has the right, but not the obligation, to call the note due in such a circumstance.

- DOT – Deed of Trust

A type of secured real estate transaction that some states use instead of mortgages. A deed of trust involves three parties: a lender, a borrower, and a trustee. The lender gives the borrower money. In exchange, the borrower gives the lender one or more promissory notes.

- EMC – Earnest money contract

A deposit made to a seller showing the buyer's good faith in a transaction.

-

FMR – Fair Market Rent

The monthly gross rent estimate used to determine rental voucher amounts for government assistance housing programs such as Section 8 (Housing Choice Voucher Program.

- FMV – Fair Market Value

A selling price for an item to which the buyer and seller can agree.

- FSBO – For Sale by Owner

The process of selling real estate without the representation of a real estate broker or real estate agent.

- GRM – Gross Rent Multiplier

The ratio of the sale or purchase price of a real estate deal to its annual rental income before deducting operating costs such as utilities, taxes, insurance, etc.

- HOA – Homeowners Association

An organization in a subdivision, planned community, or condominium that makes and enforces rules for the properties within its jurisdiction.

- IRA – Individual Retirement Account

An investing tool used by individuals to earn and earmark funds for retirement savings. There are several types of IRAs as of 2016: Traditional IRAs, Roth IRAs, SIMPLE IRAs and SEP IRAs.

- JV – Joint Venture

A commercial enterprise undertaken jointly by two or more parties that otherwise retain their distinct identities.

- L/O – Lease Option

A type of contract used in both residential and commercial real estate. In a lease option, a property owner and tenant agree that, at the end of a specified rental period for a given property, the renter has the option to purchase.

- LOI – Letter of Intent

A non-binding agreement stating two or more parties desire to enter into a real estate transaction, such as a sale or lease. The letter provides an outline of the proposed transaction so the parties can negotiate before committing to a contract.

- LPOA – Limited Power of Attorney

A legal action that allows an agent to act on behalf of a principal. When a principal signs and grants a power of attorney, he grants either general or limited authority to the agent. The limited (also known as "specific") power of attorney restricts the scope of the agent's activities.

- MAO – Maximum Allowable Offer

The maximum price point at which investors in a real estate deal can realistically expect to pull in a profit while minimizing the risk of losing money.

- MLS – Multiple Listing Service

A service used by cooperating real estate brokers who agree to combine their listings of properties for sale together into one database that is only accessible among those within the group.

- NNN – Triple Net Lease

A type of real estate lease agreement that holds the tenant or lessee responsible for the ongoing expenses of the property, including real estate taxes, building insurance, and maintenance, in addition to paying the rent and utilities.

- NOO – Non-Owner Occupied

A classification used in mortgage origination, risk-based pricing, and housing statistics for one-to-four-unit investment properties. The property is not occupied by the owner. The term non-owner occupied is not typically used for multi-family rental properties, such as apartment buildings.

- O/F – Owner Finance

When a property buyer finances the purchase directly through the person or entity selling it. This often occurs when the prospective buyer cannot obtain funding through a conventional mortgage lender or is unwilling to pay the prevailing market interest rates.

- OO – Owner Occupied

Apartment or home that is used as the primary dwelling by the owner. Commercial real estate that is used as the primary place of business for the operating business housed in said real estate.

- POA – Power of Attorney

The authority to act for another person in specified or all legal or financial matters.

- POF – Proof of Funds

A document or bank statement proving that a person has the financial ability to perform a transaction.

- PSA - Purchase Sale Agreement

An agreement used when a buyer (the offeror) intends to make an offer to the seller (the offeree). Since the Statute of Frauds requires all real estate offers to be in writing in most states, the PSA is used for this purpose.

- PUD - Planned Unit Development

A type of building development and also a regulatory process. As a building development, it is a designed grouping of both varied and compatible land uses, such as housing, recreation, commercial centers, and industrial parks, all within one contained development or subdivision.

- REO - Real Estate Owned

A class of property owned by a lender—typically a bank, government agency, or government loan insurer—after an unsuccessful sale at a foreclosure auction.

- RTO – Rent to Own

Also known as rental-purchase, "Rent 2 Own"' is a type of legally-documented transaction under which tangible property, such as furniture, consumer electronics, motor vehicles, home appliances, and real estate, is leased in exchange for a weekly or monthly payment that can be accumulated towards the eventual payment of the purchase of that property.

- SFR – Single Family Residence

a stand-alone house (also called a single-detached dwelling, detached residence, or separate house) that is a free-standing residential building. Sometimes referred to as a single-family home, as opposed to a multi-family residential dwelling.

Real Estate Finance

- ACE - The measurement of the total potential loss to a lender or lenders at any given time. The magnitude of credit exposure indicates the extent to which the lender is exposed to the risk of loss in the event of the borrower's default.

- ADR - Average Daily Rate

A statistical unit often used in the lodging industry that represents the average rental income per paid occupied room in a given time period. ADR, along with aproperty's occupancy are the foundations for its financial performance.

- AGI - Adjusted Gross Income

In the United States income tax system, adjusted gross income is an individual's total gross income minus specific deductions.

- AMORT – Amortization -

The paying off of debt with a fixed repayment schedule in regular installments over a period of time, for example with a mortgage or carloan.

- APR – Annual Percentage Rate -

The annual rate charged for borrowing or earned through an investment expressed as a percentage that represents the actual yearly cost of funds over the term of a loan.

- ARM – Adjustable Rate Mortgage

A mortgage loan with the interest rate on the note that is periodically adjusted based on an index, which reflects the cost to the lender of borrowing on thecredit markets. ARM is also sometimes called a variable-rate mortgage, or tracker mortgage.

- BOE - Back of the Envelope Analysis

An informal mathematical computation often performed on a scrap of paper, such as an envelope, uses a calculated estimation and/or rounded numbers to quickly develop a ballpark figure.

- BPO – Brokers Price Opinion or

Brokers Opinion of Value

The process used by a hired sales agent to determine the potential selling price or estimated value of a real estate property. A BPO is popularly used in situations where a financial institution believes the expense and delay of an appraisal is unnecessary.

- CAP – Capitalization or Cap Rate

A rate that helps in evaluating a real estate investment. The equation to establish cap rate of the asset is as follows: CAP net operating income/property value. Cap rate shows the potential rate of return on the real estate investment.

- CAPX - Capital Expenditures

Funds used by a company to acquire, upgrade, and maintain physical assets, such as property, industrial buildings, or equipment.

- CLTV – Combined Loan To Value

The proportion of loans (secured by a property) in relation to its value. The aggregate principal balance(s) of all mortgages on a property, divided by its appraised value or purchase price, whichever is less.

- COCR or CCR – Cash-on-Cash Return

Cash-on-cash return is a rate of return often used in real estate transactions that calculates the cash income earned on the cash invested in a property. Cash-on-cash return measures the annual return the investor made on the property in relation to the down payment only.

- COF – Cost of Funds

The interest rate paid by financial institutions for the funds that they deploy in their business.

- DCR or DSCR or DSR - Debt-Service

Coverage Ratio

A measure of the cash flow available to pay current debt obligations. The ratio states net operating income as a multiple of debt obligations due within one year, including interest, principal, sinking fund, and lease payments.

- DTI – Debt-to-Income Ratio

Away for lenders, including mortgage lenders, to measure an individual's ability to manage monthly payments and repay debts. DTI is calculated by dividing total recurring monthly debt by gross monthly income, and it is expressed as a percentage.

- EBITDA - Earnings Before Interest

Taxes Depreciation and Amortization

Net income with interest, taxes, depreciation and amortization added back to it. EBITDA can be used to analyze and compare profitability among companies and industries as it eliminates the effects of financing and accounting decisions.

- EBITDAR - Earnings Before Interest

Taxes Depreciation Amortization and

Rent

A non-GAAP indicator of a company's financial performance. The formula for calculating EBITDAR is earnings before interest and tax (EBIT) plus depreciation, amortization and restructuring or rent costs.

- EGI - Expected Gross Income

Can calculated by taking the Potential Gross Income from an investment property, adding other forms of income generated by that property, and subtracting vacancy and collection losses.

- FCF - Free Cash Flow

A measure of a company's financial performance, calculated as operating cash flow minus capital expenditures. FCF represents the cash that a company is able to generate after spending the money required to maintain or expand its asset base.

- GFE - Good Faith Estimate

An estimate of the fees due at closing for a mortgage loan that must be provided by a lender to a borrower within three days of the lender taking that borrower's loan application. A good faith estimate is required by the Real Estate Settlement Procedures Act (RESPA).

- HELOC - Home Equity Line of Credit

A line of credit extended to a homeowner that uses the borrower's home as collateral. Borrowers are pre-approved for a certain spending limit, based on household income and credit score, and may draw on this limit at their discretion.

- HML – Hard Money Lender

A specific type of asset-based loan financing through which a borrower receives funds secured by real property. Hard money loans are typically issued by private investors or companies.

- HUD – Housing and Urban Development

A federal government executive department whose purpose is to provide housing and community development assistance and to make sure everyone has access to “fair and equal” housing.

- HUD-1 - Settlement Statement

A standard form used in the U.S. to itemize services and fees charged to the borrower by the lender or broker when applying for a loan for the purpose of purchasing or refinancing real estate.

- I/O – Interest Only (loan)

A type of mortgage in which the mortgagor is only required to pay off the interest that arises from the principal that is borrowed. Because only the interest is being paid off, the interest payments remain fairly constant throughout the term of the mortgage.

- IRR – Internal Rate of Return

A metric used in capital budgeting to estimate the profitability of potential investments. The internal rate of return is a discount rate that makes the net present value (NPV) of all cash flows from a particular project equal to zero.

- JUMBO - Jumbo Mortgageof Jumbo Loan

A form of home financing required when the loan amount exceeds the threshold of conforming loan limits set by the Federal Housing Finance Agency (FHFA). As a result, unlike conventional mortgages, it is not eligible to be purchased, guaranteed, or securitized by Fannie Mae or Freddie Mac

- L/C - Letter of Credit

A letter issued by a bank to another bank (typically in a different country) to serve as a guarantee for payments made to a specified person under specified conditions.

- LIBOR or ICE LIBOR – London

Interbank Overnight Rate

A benchmark rate that some of the world's leading banks charge each other for short-term loans. It serves as the first step to calculating interest rates on various loans throughout the world.

- LOC – Line of Credit

An arrangement between a financial institution-usually a bank-and a customer that establishes a maximum loan balance that the lender permits the borrower to access or maintain.

- LTC - Loan to Cost

A ratio metric used in commercial real estate construction to compare the financing of a project as offered by a loan, to the cost of building the project. The LTC ratio allows commercial real estate lenders to determine the risk of offering a construction loan.

- LTV – Loan to Value

Used by lenders to express the ratio of a loan to the value of an asset purchased. The term is commonly used by banks and building societies to represent the ratio of the first mortgage line as a percentage of the total appraised value of real property.

- MIP - Mortgage Insurance Premium

An insurance policy used in Federal Housing Administration (FHA) loans if the down payment is less than 20%. The FHA assesses either an "upfront" MIP (UFMIP) at the time of closing, or an annual MIP that is calculated every year and paid in 12 installments.

- NOI – Net Operating Income

A calculation used to analyze real estate investments that generate income. Net operating income equals all revenue from the property, minus all reasonably necessary operating expenses.

- OpEx – Operating Expenses

Ongoing costs incurred in the operation and maintenance of a commercial property. Unlike CapEx, OpEx arefully tax-deductiblein the year they are incurred.

- P&I - Principal & Interest

Payments on a loan that the borrower is responsible for, according to an agreed-upon schedule.

- P&L - Profit and Loss Statement

A financial statement that summarizes the revenues, costs,and expenses incurred during a specific period of time, usually a fiscal quarter or year.

- PE - Private Equity

Capital that is not listed on a public exchange. Private equity is composed of funds and investors that directly invest in private companies, or that engage in buy outs of public companies, resulting in the delisting of public equity.

- PFS - Personal Financial Statement

A document or spreadsheet outlining an individual's financial position at a given point in time. A personal financial statement will typically include general information about the individual, such as name and address, along with a breakdown of their total assets and liabilities.

- PG - Personal Guarantee

An individual's legal promise to repay charges to a business creditcard. Providing a personal guarantee means that if the business becomes unable to repay its credit card debts, the individual guarantor is personally responsible.

- PGI - Potential Gross Income

The total rent a property could generate is 100% leased at market rent

- PITI – Principal, Interest, Taxes

and Insurance

An acronym for a mortgage payment that is the sum of monthly principal, interest, taxes, and insurance.

- PMI – Private Mortgage Insurance -

A special type of insurance policy, provided by private insurers, to protect a lender against loss if a borrower defaults

- PRIME - PrimeRate or Prime Lending

Rate

An interest rate used by banks, usually the interest rate at which banks lend to favored customers (i.e., those with good credit).

- REVPAR - Revenue Per Available Room

A performance metric used in the hotel industry that is calculated by multiplying a hotel's average daily room rate (ADR) by its occupancy rate. It may also be calculated by dividing a hotel's total room revenue by the total number of available rooms in the period being measured.

- ROI – Return On Investment

Usually expressed as a percentage, ROI is typically used for personal financial decisions, to compare a company's profitability or the efficiency of different investments. The return-on-investment formula is: ROI =(Net Profit / Cost of Investment) x 100.

- SWAP - Interest Rate Derivative

A derivative contract through which two parties exchange financial instruments. These instruments can be almost anything, but most swaps involve cash flows based on a notional principal amount to which both parties agree. The most common type of swap is an Interest Rate swap.

- TAV - Tax Assessed Value

The dollar value assigned to a property to measure applicable taxes. Assessed valuation determines the value of a residence for tax purposes and takes comparable home sales and inspections into consideration.

- VAC - Vacancy Rate

The percentage of all available units in a rental property, such as a hotel or apartment complex, that are vacant or unoccupied at a particular time. It is the opposite of the occupancy rate, which is the percentage of occupied units in a rental property.

- VC - Venture Capital

Capital invested in a project in which there is a substantial element of risk, typically a new or expanding business.

Business Ownership

- 1040 - Personal Tax Return Form

The standard Internal Revenue Service (IRS) form that taxpayers use to file their annual income tax returns.

- 1120 - Corporate Tax Return Form

A tax document used to report the income, losses, and dividends of corporate shareholders. It is a corporation’s tax return.

- 4506-T - Request for Transcript of

Tax Return

An Internal Revenue Service (IRS) document that is used to retrieve past tax transcripts that are on file with the IRS. The document must be signed and dated by the taxpayer, thus giving a third party permission to retrieve the taxpayer's data.

- K-1 - Tax Form for reporting income

from Partnerships, S-Corps, and some

Trusts

A tax document used to report the incomes, losses, and dividends of a partnership. The Schedule K-1 document is prepared for each individual partner and is included with the partner's personal tax return

- LLC – Limited Liability Company

A corporate structure whereby the members of the company cannot be held personally liable for the company's debts or liabilities. Limited liability companies are essentially hybrid entities that combine the characteristics of a corporation and a partnership or sole propriet or ship

- LLP – Limited Liability Partnership

A partnership in which some or all partners (depending on the jurisdiction) have limited liabilities. It, therefore, exhibits elements of partnerships and corporations. In an LLP, each partner is not responsible or liable for another partner's misconduct or negligence.

- TIC - Tenancy In Common

Allows two or more people ownership interests in a property. Each owner has the right to leave his share of the property to any beneficiary upon the owner's death.

- W2 - Detailed Income and Tax

Withholding Form

A standard tax form showing the total wages paid to an employee and the taxes withheld during the calendar year, prepared by an employer for each employee.

Business Finance

- 504 - SBA 504 Loan Program

Or the Certified Development Company program, is a US Small Business Administration program designed to provide financing for the purchase of fixed assets, which usually means real estate, buildings, and machinery, at below-market rates. The 504 program works by distributing the loan among three parties (bank, CDC, and borrower equity).

- 7A - SBA 7A Loan Program

The most basic and most used type of loan of the Small Business Administration's (SBA) business loan programs. Its name comes from section 7(a) of the Small Business Act, which authorizes the agency to provide business loans to American small businesses.

- A/P - Accounts Payable

An accounting entry that represents an entity's obligation to pay off a short-term debt to its creditors. On many balance sheets, the accounts payable entry appears under the heading “current liabilities”.

- A/R - Accounts Receivable

Refers to the outstanding invoices a company has or the money the company is owed from its clients. On a balance sheet, the accounts receivable entry appears under the heading “current assets”.

- C&I - Commercial & Industrial Loan

A loan to a business rather than a loan to an individual consumer. These short-term loans may have an interest rate based on the LIBOR rate or prime rate and are secured by collateral owned by the business requesting the loan.

- CDC - Certified Development Company

for SBA 504 Loans

A nonprofit corporation set up to contribute to the economic development of its community. CDCs work with the SBA and private-sector lenders to provide financing to small businesses.

- SBA - Small Business Administration

A United States government agency that provides support to entrepreneurs and small businesses. SBA loans are made through banks, credit unions, and other lenders who partner with the SBA. The SBA provides a government-backed guarantee on part of the loan. Under the Recovery Act and the Small Business Jobs Act, SBA loans were enhanced to provide up to a 90-percent guarantee in order to strengthen access to capital for small businesses after credit froze in 2008.

- UCC - Uniform Commercial Code

A standard set of business laws that regulate financial contracts. The Uniform Commercial Code has been adopted by most states in the U.S. The UCC better enabled lenders to loan money secured by the borrower's personal property.

- WIP - Work In Process

Refers to raw materials, labor, and overhead costs incurred for products that are at various stages of the production process. WIP is a component of the inventory asset account on the balance sheet, and these costs are transferred to the finished goods account and eventually to the cost of sale.

Regulatory

- FCRA – Fair Credit Reporting Act

Is the act that regulates the collection of credit information and access to your credit report. It was passed in 1970 to ensure fairness, accuracy, and privacy of the personal information contained in the files of the credit reporting agencies.

- FDIC – Federal Deposit Insurance

Corporation -

The U.S. corporation insuring deposits in the United States against bank failure. The FDIC was created in 1933 to maintain public confidence and encourage stability in the financial system through the promotion of sound banking practices.

- FEMA – Federal Emergency Management

Agency -

a federal agency that coordinates the response to disasters in the U.S

- FHA – Federal Housing Administration

A United States government agency created in part by the National Housing Act of1934. The FHA sets standards for construction and underwriting and insures loans made by banks and other private lenders for home building.

- FHLMC – Freddie Mac (Federal Home

Loan Mortgage Corporation) -

Freddie Mac (FHLMC) is a stockholder-owned, government-sponsored enterprise (GSE) chartered by Congress in 1970 to keep money flowing to mortgage lenders in support of home ownership and rental housing for middle-income Americans.

- FICO - Fair Isaac Credit Co

A FICO score is a type of credit score created by Fair, Isaac and Company. Lenders use borrowers' FICO scores, along with other details on their credit reports, to assess credit risk and determine whether to extend credit.

- FNMA - Fannie Mae

A government-sponsored enterprise that buys loans from mortgage lenders, packages them together and sells them as a mortgage-backed security to investors on the open market.

- GNMA - Ginnie Mae (Government

National Mortgage Association)

A U.S. government corporation within the U.S. Department of Housing and Urban Development (HUD) that aims to: 1. ensure liquidity for government-insured mortgages, including those insured by the Federal Housing Administration (FHA), the Veterans Administration (VA), and the Rural Housing Administration (RHA) 2. bring investor’s capital into the market for these types of loans, so that the issuers have the means to issue more.

- TIL/ TILA – Truth In Lending Act

A United States federal lawenacted in 1968 to help protect consumers in their dealings with lenders. It was designed to advance the informed use of credit among consumers by standardizing the manner in which costs associated with borrowing must be calculated and disclosed by creditors.

- VA – Department of Veterans Affairs

/ Veterans Administration

The second-largest cabinet department of the federal government, the VA coordinates the distribution of benefits for veterans of the American armed forces and their dependents. The benefits include compensation for disabilities, the management of veteran's hospitals, and various insurance programs.

Designations

- ABR® – Accredited Buyer

Representative

A designation designed for real estate buyer agents who focus on working directly with buyer-clients.

- AMO® – Accredited Management

Organization -

The mark of distinction among real estate management firms, awarded by the Institute of Real Estate Management (IREM).

- CBR® – Certified Buyer

Representative

A buyer agent specially trained to represent the buyers, helping them get the best possible price for the home they desire.

- CCIM – Certified Commercial

Investment Member

A membership denotes the completion of advanced course work in financial and market analysis and extensive experience in the commercial real estate industry. CCIM designees are recognized as leading experts in commercial investment real estate.

- CFA® - Chartered Financial Analyst

A professional designation given by the CFA Institute, formerly Association for Investment Management and Research (AIMR), that measures the competence and integrity of financial analysts.

- CHMS – Certified Home Marketing

Specialist

A real estate designation achieved upon completion of courses centered on staging concepts and strategic marketing inreal estate.

- CLHMS™ – Certified Luxury Home

Marketing Specialist

Recognized as the mark of accomplishment in luxury markets around the world, the CLHMS designation assures affluent buyers and sellers that the agents who have earned it have the knowledge, experience, competence, and confidence they require.

- CNS/ RENE – Certified Negotiation

Specialist

A designation offered by the National Association of Realtors® (NAR) for realtors who have taken specialized courses in negotiations. Also called the RENE (Real Estate Negotiation Expert) certification.

- CPM® – Certified Property Manager

A real estate professional designation awarded by the Institute of Real Estate Management (IREM) and recognized by the National Association of Realtors® (NAR).

- CRB – Certified Real Estate Broker

The Certified Real Estate BrokeR is a designation that raises professional standards, strengthens individual and office performance and indicates expertise in brokerage management. This designation represents the highest level of professional achievement in real estate brokerage management.

- CRS – Certified Residential

Specialist

The highest credential awarded to residential sales agents, managers,and brokers through the National Association of Realtors® (NAR).

- GRES – Graduate Real Estate Societ

Graduate student membership programsfor students, typically those earning an MBA in real estate, that are organized and offered at universities throughout the country.

- GRI – Graduate REALTOR® Institute

Offered through the National Association of Realtors® (NAR), a realtor witha GRI designation has achieved in-depth knowledge of technical subjects as well as the fundamentals of real estate.

- MAI - Member Appraisal Institute

A professional designation offered by the Appraisal Instituteand held by appraisers who are experienced in the valuation and evaluation of commercial, industrial, residential, and other types of properties, and who advise clients on real estate investment decisions.

- MBA - Master of Business

Administration

A graduate degree that provides students with practical and theoretical training to aid them in better understanding the general functions of business management.

- MSRE - Master of Science in Real

Estat

A graduate degree offered through top business universities that combines the teachings of comprehensive business management with the detailed study of real estate markets and the real estate asset class.

- NAR – National Association of

Realtors®

A North American trade association for professionals in the realestate industry.

- REALTOR® – Member ofthe National

Association of Realtors®

A dues-paying member of the National Association of Realtors® who acts as an agent for the sale and purchase of buildings and land.

- REIA – Real Estate Investors

Association

A national association with local chapters whose mission is to provide a forum both for networking as well as for professional-level training in real estate investment.

- SRES® – Senior Real Estate

Specialist®

Offered by the Senior Real Estate Specialist Council®, the SRES® designation provides REALTORS® with the knowledge and tools required to understand and cater to the unique needs of buyers and sellers over the age of 50.